How to Run Your Vacation Rental Property: DIY vs Host vs Professional Agent Models

Owning a vacation rental in Cape Town can be a powerful wealth-building tool — but how you manage it can make or break your returns. Do you roll up your sleeves as a DIY operator or do you outsource everything to a full-service agency and focus on your primary income? Is the stress and effort of managing a vacation rental yourself worth it, and are you maximising returns going it alone?

In this article we will provide an objective breakdown of the income, costs, and effort associated with each model, fuelled by The 7 Laws of Wealth-Building with Vacation Rental Property.

Tips to Maximise Your Vacation Rental Investment

- DIY - Manage the property yourself

- Co-host - Find a family member, friend or one-man-band who does this for extra cash

- Professional Agency - or partner with a professional vacation rental agency in Cape Town to handle everything

Looking Beyond the Management Fees

The investment you’re looking to utilise as an income stream most likely came at a cost (and not purely a financial one), and so it’s natural to want to extract as much value out of it as possible. The thing is, when you’re deciding on how you’re going to manage the property it’s important that you don’t only consider the immediate costs should professional management be included in the mix.

The decision you make directly impacts your returns, your stress levels, and whether you own a passive investment or a second job. Yes, if you go it alone you avoid the costs associated with a professional service, but the mistake many investors make is to simply compare direct fees alone.

The true cost of management lies in the unseen effort, hidden expenses, and the immense lost opportunity from not maximising your property's potential. The hours you spend managing bookings, the stress of handling emergencies, and the revenue lost to a limited marketing reach are all real costs that eat into your profit and peace of mind. Added to that, while you may see yourself as a hospitality expert, sometimes it’s smarter to leave it up to the professionals who do this day in and day out.

Vacation Rental Management Matrix: DIY vs Co-Host vs Professional Agent Models

So, how much does it cost to run an Airbnb if you outsource the product to the professionals?

The following table provides a high-level overview that summarises the core trade-offs between the three primary management models.

Vacation rental pricing comparison

| Cost | DIY | Co-Host | Professional Agency |

|---|---|---|---|

| Fees | Platform ave - 18.46% Total: 15% | Platform ave - 18.46% Host: 15-20% Total: 30%-35% | Platform ave - 18.46% Host: 15-25% Total: 30%-40% |

| Occupancy | Typically gets revenue from 2 platforms: Airbnb & Bookings.com 40% of market. | Typically gets revenue from 2 platforms: Airbnb & Bookings.com 40% of market. | Derives revenue from Airbnb, Bookings.com & roughly 100 other platforms & Private and Corporate bookings 95% of market. |

| Revenue Optimisation | Poor - Relies on gut & guesswork, leading to undercharging of missing bookings. | Good - Relies on industry experience and has dedicated time to market research. | Maximised revenue - Data-driven real-time price adjusting technology that is only available at the scale of an agent. |

| Time & Stress | 24/7 Standby for emergencies, booking correspondence, guest check-in & prepping for guests. | 5-10 hours a week administering platforms, ordering products and making payments. | Zero hours. All bookings, bills, maintenance, emergencies, cleaning & services handled by agency. |

| Guest Value | Limited to what the property offers and owner’s resources. | Possible deals and discounts with pamphlets and email. | Dedicated guest concierge services that are constantly identifying and offering an enhanced guest experience. |

| Community Investment | Zero to none. | Possible, but varies from host to host. | Ongoing programs in place with teams and resources allocated to execute. |

| Brand Building | Adhoc reviews, prompted by platform automations. | Adhoc reviews, prompted by platform automations. | Platform reviews & Proactive review requests for individual properties on Google and all individual review platforms (hello peter, trip advisor etc.), with processes for acting on feedback. |

| Risk Cover | Reliant on insurance from household and generic platform policies. | Reliant on insurance from household and generic platform policies. | Additional layer of professional protection with industry approved insurance. |

| Protection from Guests | Reliance on guest details supplied via booking platforms. | Reliance on guest details supplied via booking platforms. | 24/7 response to issues. Independent client vetting and approval software. Deposit management policy. |

| Regulatory Exposure | Must stay abreast of the legislature which is subject to the whims of government regulation. | Must choose a Host who is abreast of the legislature which is subject to the whims of government regulation. | The agency is actively engaging with policy making and regulations, and preparing properties to meet the standards of the future. |

The above is only a guide to what the typical scenarios look like, but each property and each market has nuances that may further impact your decision. It’s best to speak to the vacation rental professionals, like MUi STAYS.

These numbers show the potential. Find out what your property could achieve.

Complete the form here to book a call with us here to get an instant financial projection for your property.

Beyond the Fees: A Real-World Case Study

Now that you’ve seen the high-level overview in the matrix, let’s apply these principles to a tangible, real-world case study for the remainder of this article. Here we’re looking at our own in-house management systems compared with performance data from the Airbnb platform for a typical single-bedroom apartment in Muizenberg, valued at R1,900,000. By ‘typical’ we mean that there was nothing special about it - no unique selling points, no frills or special features.

We’ve broken this down into three key components three key stages:

- Breaking Down Property Management: 9 Critical Tasks for Investors

- Vacation Rental Revenue: Projected Cashflow from a Case Study

- Vacation Rental Capital Appreciation: Combining Annual Profit with Capital Growth

Viewing a management fee as a simple expense is a common mistake; it should be seen as an investment in maximising your total return..

1. Breaking Down Property Management: 9 Critical Tasks for Investors

To understand how the different management models lead to such vastly different financial outcomes, we need to dissect the essential day-to-day tasks of running a successful vacation rental in Cape Town. The value of a professional agency becomes clear when you see how they handle each component systematically, turning potential owner stress into operational excellence.

Here’s how the three models stack up across the nine critical elements of property management.

4.1. Guest Communication & Support

- DIY (Owner-Managed): The owner is responsible for all guest inquiries, pre-arrival questions, in-stay issues, and post-stay follow-ups, 24/7. This is a high-stress, high-time commitment that directly impacts review quality. This is a difficult approach for someone with a full-time job.

- Co-Host Model: A co-host handles most guest communication, but the owner often remains involved in escalations or complex issues. The quality of service can vary greatly depending on the individual co-host.

- Professional Agency (MUi STAYS Model): Utilises a dedicated, 24/7 support team to provide professional, 5-star service. This ensures rapid response times and consistent quality, leading to better reviews (broader market appeal and improved public brand perception) and guest satisfaction.

4.2. Marketing & Listing Optimisation

- DIY (Owner-Managed): Owners typically only list on Airbnb, potentially leaving up to 75% of revenue on the table. And for DIY owners, listing optimisation is often guesswork.

- Co-Host Model: A co-host may have more experience with basic listing optimisation but still lacks the access to a full spectrum of booking channels.

- Professional Agency (MUi STAYS Model): Employs professional distribution across over 100 channels plus direct corporate and tourism networks, unlocking the full 75% of the market that DIY managers miss (a key part of Law #2: Cash Flow ).

4.3. Pricing Strategy & Revenue Management

- DIY (Owner-Managed): Pricing is often based on guesswork or simply copying neighbours, leading to a high risk of devaluing the property or missing out on peak-season revenue.

- Co-Host Model: Can offer basic pricing advice based on experience, but typically lacks sophisticated, data-driven tools.

- Professional Agency (MUi STAYS Model): Uses dynamic, data-driven technology to adjust pricing in real time, maximising revenue and protecting the property's brand from devaluation (as outlined in

Law #7: Brand Integrity ).

4.4. Cleaning & Turnover Management

- DIY (Owner-Managed): Finding, training, and scheduling reliable cleaners is time-consuming and fraught with potential inconsistency, which is a common cause of poor reviews.

- Co-Host Model: Provides basic oversight of cleaning staff but may not have formalised checklists or inspection processes.

- Professional Agency (MUi STAYS Model): Uses professionally trained cleaning teams with automated scheduling and quality control systems to ensure a consistent, 5-star level of cleanliness for every guest arrival (a core principle of

Law #3: Operational Efficiency ).

4.5. Maintenance & Repairs

- DIY (Owner-Managed): Dealing with maintenance is unpredictable, stressful, and often costly, as owners lack a network of vetted, reliable contractors for emergency call-outs.

- Co-Host Model: Offers basic coordination for repairs, acting as a point of contact but without the 24/7 response systems of an agency.

- Professional Agency (MUi STAYS Model): Provides proactive maintenance plans and a 24/7 emergency response team with a network of vetted professionals, ensuring issues are resolved quickly and cost-effectively.

4.6. Financial Reporting & Analytics

- DIY (Owner-Managed): Financial tracking is typically manual, time-consuming, and prone to errors, providing no real performance insights.

- Co-Host Model: May provide limited, basic summaries of income and expenses.

- Professional Agency (MUi STAYS Model): Offers transparent, real-time financial dashboards, providing owners with clear insights into their property's performance and making tax preparation effortless.

4.7. Brand Building & Reputation Management

- DIY (Owner-Managed): Reputation management is reactive and vulnerable to the whims of a few bad reviews.

- Co-Host Model: Has a limited scope for proactive brand building beyond the standard platform review requests.

- Professional Agency (MUi STAYS Model): Proactively manages reputation to build a 4.5+ star brand that can command a 10-20% price premium over comparable listings (as detailed in

Law #7: Brand Integrity ).

4.8. Local Community & Partnership Integration

- DIY (Owner-Managed): Building strategic local partnerships lacks scale and requires very high effort, resulting in a missed Return on Involvement.

- Co-Host Model: May have limited local connections but cannot formalise partnerships at a scale that provides significant value.

- Professional Agency (MUi STAYS Model): Uniquely able to operate at scale to engage in active civic improvement (like the Muizenberg beach hut preservation) and secure exclusive guest deals, such as discounts at local restaurants or free surf lessons. This enhances the guest experience, drives referrals, and boosts property value (directly applying

Law #5: Community and Law #6: Partnerships ).

4.9. Problem Solving & Crisis Management

- DIY (Owner-Managed): A crisis like a burst geyser or a security issue can cause extreme stress and lead to costly errors when handled without experience. The owner is on call 24/7.

- Co-Host Model: Response to crises can be variable depending on the individual co-host’s experience and availability.

Professional Agency (MUi STAYS Model): Has dedicated 24/7 support and established protocols for handling any crisis, giving the owner complete peace of mind.

2. Vacation Rental Revenue: Projected Cashflow from a Case Study

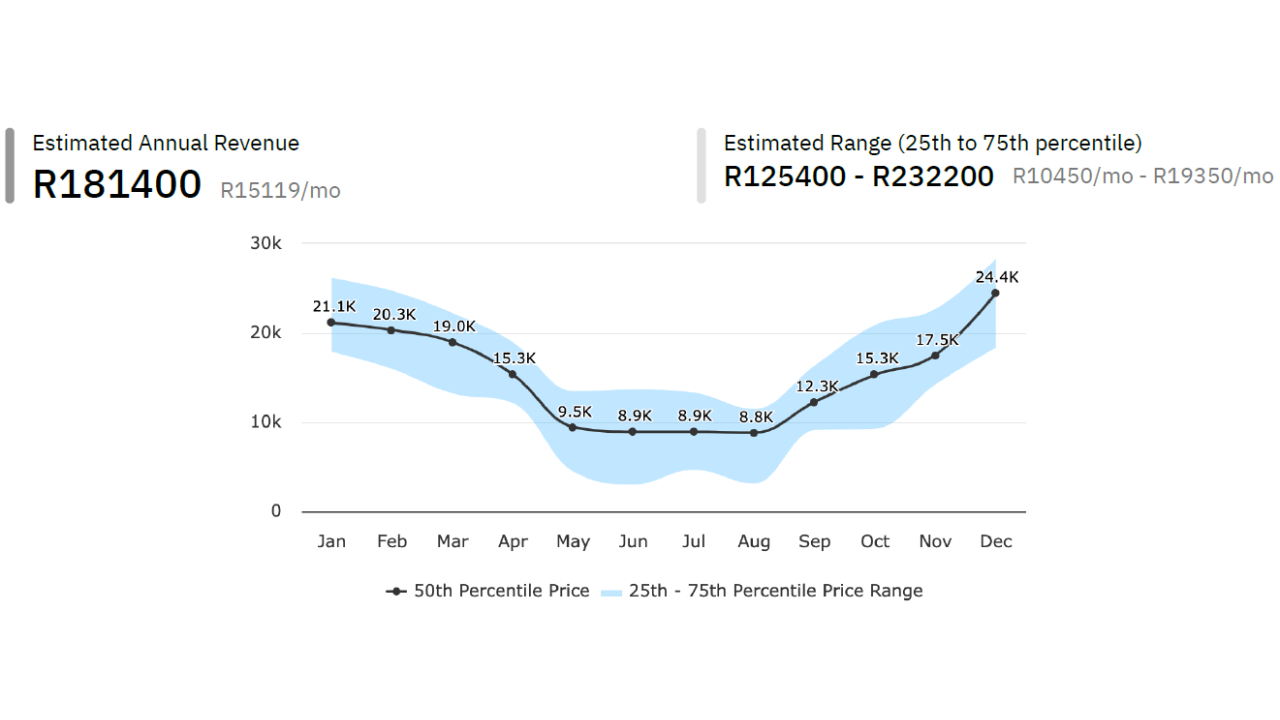

Now we debate the numbers. By applying the fee structures and operational costs to our average R1,900,000 single apartment, we can see the real-world net profit and return on investment for each management model. For this comparison, we’ve included an estimate for Turnover & Operational Costs (guest supplies, professional laundry, minor maintenance) at a conservative 15% of gross revenue for all models.

For this comparison, we will use the following, more detailed fee structure:

- Platform Fees: We will use a blended average of 18.5% for platform fees. This is calculated from the updated host fees on major platforms (e.g., Airbnb at 15% + VAT, and Booking.com at 15% + VAT plus additional payout fees).

- Turnover & Operational Costs: 15% of gross revenue for all models.

- Management Fees: 0% for DIY, 15% to 25% for Co-Host, and 20% to 30% for Professional Agency.

Scenario 1: The DIY Investor

This investor relies solely on platform bookings and manages everything themselves.

- Gross Revenue: R181,000

- Less Platform Fees (18.46% of Gross): -R33,413

- Less Turnover & Operational Costs (15% of Gross): -R27,150

- Net Revenue (Before Owner's Time): R120,437

Scenario 2: The Co-Host Model

This investor hires a co-host to manage the property, who charges a fee on top of the platform and operational costs.

- Gross Revenue: R181,000

- Less Platform Fees (18.46% of Gross): -R33,413

- Less Co-Host Management Fee (15% of Gross): -R27,150

- Less Turnover & Operational Costs (15% of Gross): -R27,150

- Net Revenue (Before Owner's Time): R93,287

Scenario 3: The Professional Agency Model (MUi STAYS)

The agency achieves higher gross revenue through a multi-channel strategy where 50% of bookings are direct (no platform fees).

- Gross Revenue: R282,000

- Less Platform Fees (18.46% on 50% of bookings): -R26,029

- Less Pro Management Fee (21.5% of Gross): -R60,630

- Less Turnover & Operational Costs (15% of Gross): -R42,300

- Net Revenue (Passive Income): R153,041

Final ROI Showdown

Here we calculate the final annual return on the

R1,900,000 property investment, factoring in the true net revenue of each model.

| Model | Net Revenue | Owner's Time Cost | Email AddreTrue Annual ROIss |

|---|---|---|---|

| DIY Investor | R120,437 | High (Active Job) | 6.3% |

| Co-Host | R93,287 | Medium (Still Involved) | 4.9% |

| Professional Agency | R153,041 | Zero (Truly Passive) | 8.3% |

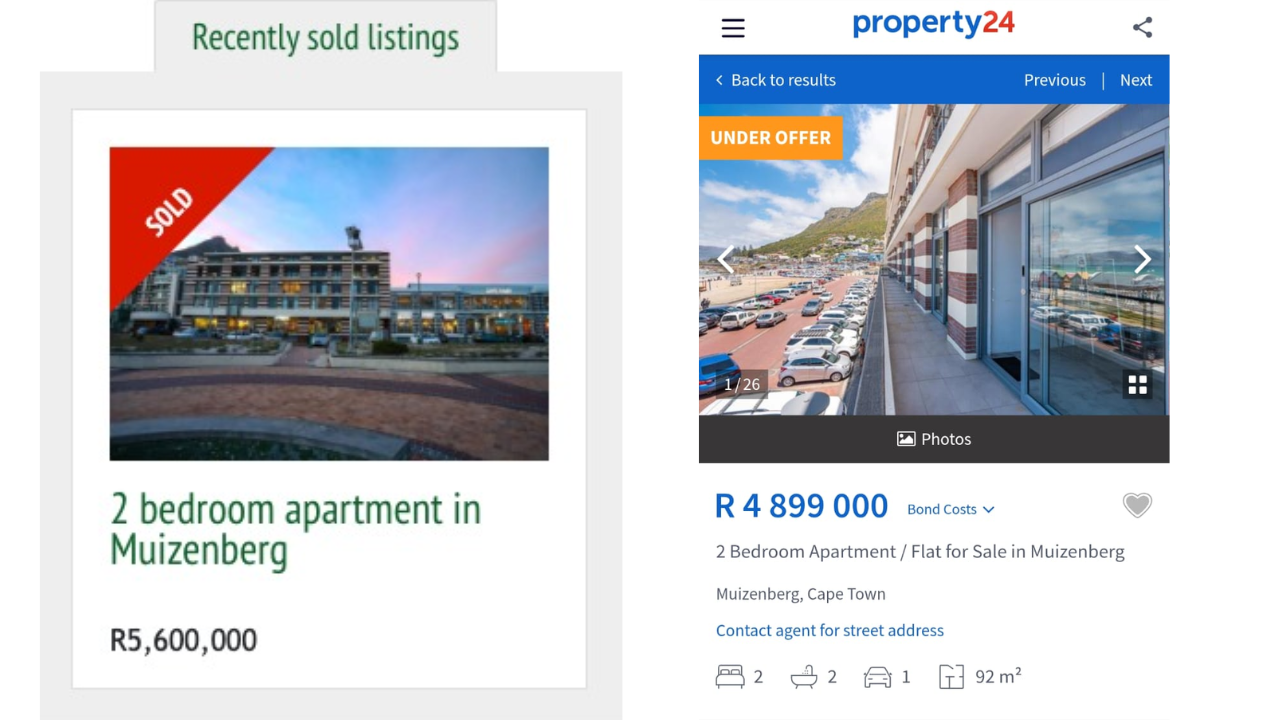

Vacation Rental Capital Appreciation: Combining Annual Profit with Capital Growth

We’ve seen the difference in annual cash flow, but the ultimate value of an investment is realised upon its sale. This is where professional management creates a significant, often overlooked, financial advantage.

Instead of relying on hypothetical discounts or premiums, let's look at a real-life market example. Recently, two similar two-bedroom, sea-facing apartments in the area were listed for R5.5 million at the same time:

- One property, managed by MUi STAYS, had a complete history of bookings, revenue, and guest reviews. It sold within 24 hours at the full asking price of R5.5 million.

- The other, a self-managed property, sat on the market for five months and was finally sold for R4.9 million.

Why the R600,000 difference and the drastically faster sale? The MUi STAYS property was not just bricks and mortar; it was a verifiable, turn-key business. The historical performance data gave the buyer deep insight into the "going concern" they were acquiring, justifying the sales price and making the purchase decision a confident one. The self-managed property lacked this proof, leading to uncertainty, prolonged negotiation, and a substantial loss in value for the owner.

While the table below uses a conservative baseline of 7% capital appreciation for all models to ensure a fair comparison, keep in mind that this real-world example demonstrates the potential for a much greater upside with professional management. The table combines this appreciation with your compounded earnings to reveal the Total 5-Year ROI—the complete percentage return on your initial investment.

Total Investment Value Projection (5-Year Horizon @ 7% Growth)

| Management Model | Base Value | 5 Years Appreciation | 5 Year Net Earnings + Interest | Total 5-Year ROI (%) |

|---|---|---|---|---|

| DIY Investor | R1,900,000 | R2,664,847 | R712,999 | 76.7% |

| Co-Host | R1,900,000 | R2,664,847 | R556,869 | 68.5% |

| Professional Agency | R1,900,000 | R2,664,847 | R896,000 | 86.6% |

As the numbers clearly show, while a co-host offers a respectable return, the professional agency model adds nearly R300,000 (ROI of 86.6% is over 18 percentage points higher) more to the investor's pocket over five years. Added to that, the heavy lifting is all managed by the professionals, making it a truly passive gain.

This means that the gap between the DIY approach (76%) and professional management is, based on the above example, over R160,000. This proves that the short-term cost of an agency fee is minuscule compared to the significant long-term value created through higher earnings, compounded returns, and superior capital growth.

Conclusion: From Active Manager to Strategic Investor

The choice between DIY, co-host, and professional management is perhaps the most significant of all.

The data-driven forecast of our R1.9 million case study (with real data) leaves no room for doubt: while a DIY approach can quickly become a low-paying, high-stress job, and a co-host offers a safer middle ground, only a professional agency operates as a true wealth-creation engine.

At the end of the day, the choice defines your role in the asset and whether or not you are able to maximise returns.

The first step is understanding what your property should be earning. To get a free calculation to know exactly what sort of value you can unlock, book a free consultation on our ‘Manage My Property’ page.

As one of Cape Town’s most trusted vacation rental management partners, we’ve helped hundreds of property owners like you extract the most value out of their investment as possible.